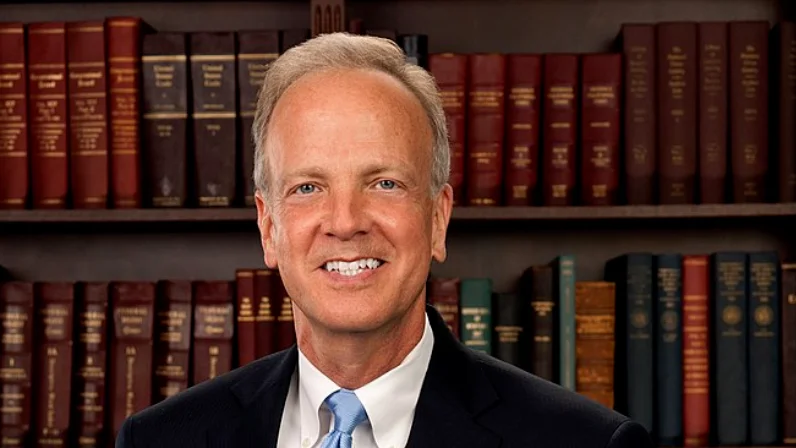

Sen. Jerry Moran, US Senator for Kansas | Official U.S. Senate headshot

Sen. Jerry Moran, US Senator for Kansas | Official U.S. Senate headshot

U.S. Senators Jerry Moran (R-Kan.) and Jacky Rosen (D-Nev.) have introduced a bipartisan bill aimed at reducing taxes for veterans who open small businesses in underserved communities. The Veterans Jobs Opportunity Act proposes a 15 percent tax credit on the first $50,000 of startup costs for veterans launching new businesses.

“By offering support to veteran entrepreneurs, we can help bolster local economies and help veterans channel the military work ethic into creating new businesses,” said Sen. Moran. “Veteran-owned small businesses play an important role in rural communities and underserved areas, and this legislation will empower veterans to start their own businesses while benefiting the communities they invest in.”

Sen. Rosen added, “Our veterans deserve to have every resource available as they transition into civilian life. I’m proud to work across the aisle to cut taxes for Nevada veterans who start small businesses in our state and create jobs. As long as I’m in the Senate, I’ll continue working to ensure our veterans have all of the resources they need.”

The proposed legislation is designed to encourage entrepreneurship among veterans while supporting economic growth in areas that may lack business development.

Alerts Sign-up

Alerts Sign-up